In this article, I will explain how to get a tax refund at Incheon International Airport including korea tax refund system.

After Shopping : Tax refund

After a pleasant trip in Korea, you must have done a lot of shopping. You bought a bunch of presents for your lover, parents, and friends, and now you have to go home through Incheon International Airport.

What you need at this time is to get back the taxes you paid for the goods you bought in Korea. When you buy something in Korea, the tax you pay is 10% value added tax(VAT).

Because you are not a Korean citizen, you do not have to pay taxes to Korea. Since this amount is larger than expected, we recommend that you get a refund.

Korea’s duty-free system is divided into two parts.

Duty Free: VAT is not included in the price of goods. These stores are mainly located at international airports including Incheon International Airport and large department store chains such as Lotte, Shilla, Shinsegae and Hyundai.

Duty-free shops are located in Seoul and other major cities and provinces. In addition, items purchased here can be sent directly to the departure airport or port, eliminating the hassle of carrying and packing additional items. Requirements are a departure ticket and passport. Required for purchasing and receiving duty-free goods.

Tax Refund: This is a system in which the tax is refunded after paying the price including tax and going through a certain procedure before leaving the country. However, tourists can easily get an instant tax refund within certain limits when shopping at duty-free certified stores. Department stores, outlet and hypermarkets immediately implemented the duty-free refund system first, and now it is expanding to small stores. Ask the shop you visit first to see whether an immediate refund is possible.

Eligible for tax refund

- Departure after purchasing more than 30,000 won within 3 months from the date of purchase

- Foreigner (Less than 6 months of stay in Korea)

- Overseas Koreans (more than 2 years of residence abroad and less than 3 months of residence in Korea)

- A single payment amount of 30,000 won or more and less than 500,000 won (tax included), total purchase amount less than 2.5 million won during the period of travel in Korea

- Persons not obligated to pay taxes in Korea

Things to consider when shopping.

- First of all, make sure to check whether the store is eligible for VAT tax refund. The logo should look like the one below. Stores that can refund must have a Tax Free sign, and the VAT refund receipt must have Tax Free written on it.

- Purchase receipts and VAT refund documents are required. If you do not apply for VAT refund documents, you cannot receive a refund, and refunds may be refused even if the documents are incomplete.

- The issued purchase receipt and documents for refund must be kept until departure.

Tax Refund Application

In case of boarding with items subject to refund

- Check in at the airline counter and get your boarding pass.

- Items for which VAT refund is requested and related documents must be carried instead of checked in as baggage.

- Visit the kiosk in the departure hall and process it.

- If you are marked as subject to customs inspection at the kiosk, submit your passport, purchased items (limited to unopened and unused items), and product sales confirmation to the customs desk and receive confirmation of taking out.

- Real cash refund received after security check

In case of check-in for items subject to refund as checked baggage

- During check-in, inform the airline staff that there are items subject to VAT refund in your checked baggage.

- Attach a tag to the baggage to receive it back for verification by customs.

- Visit the kiosk located in the departure hall and process it.

- If you are marked as subject to customs inspection at the kiosk, submit your passport, purchased items (limited to unopened and unused items), and product sales confirmation to the customs desk and receive confirmation of taking out.

- Baggage that has been checked by customs is put on the large baggage conveyor belt right next to it.

Tax Refund

VAT refund through the counter

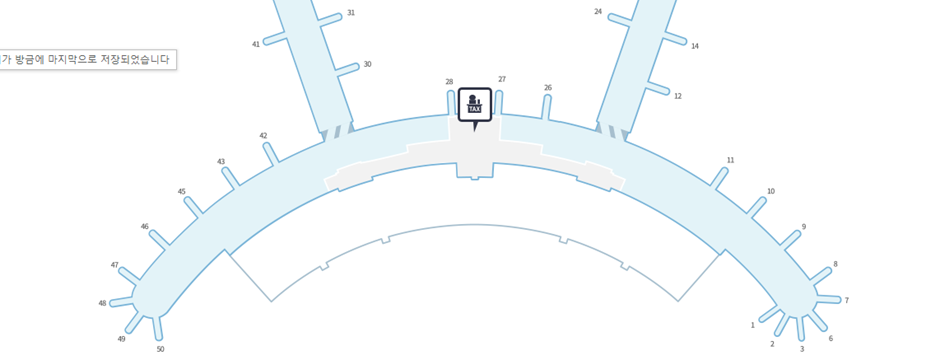

Passenger Terminal 1

- Operation Hours: 07:00 ~ 19:00

- Contact: 032-743-1009

- Location: the center of the departure hall on the 3rd floor (near Gate 28)

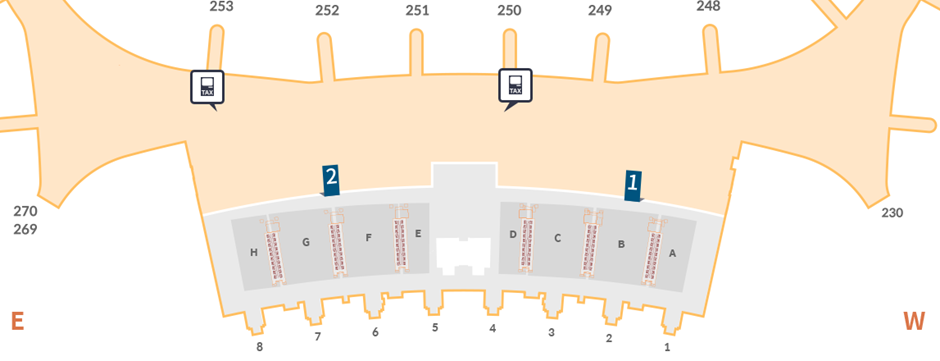

Passenger Terminal 2

- Operation Hours: 07:00 ~ 21:00

- Contact: 032-743-0647

- location

- Near check-in counters D and E on the 3rd floor of the departure area

- Near Gate 253 on the 3rd floor of the duty-free area

VAT refund using Kiosk

• When the passport is recognized by the automated machine, the refund amount is paid according to the details already approved.

• If your refund is large or you don’t want to pay in cash, you can pay back on your own credit card.

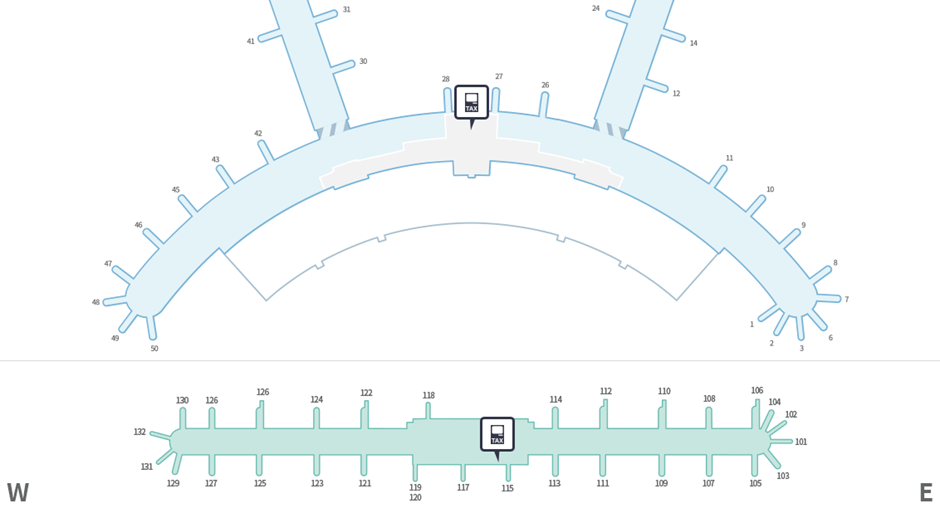

Passenger Terminal 1 & Concourse Building

Operation hours: 24 hours

Contact: 032-743-1009

Location:

- Near Gate 28 on the 3rd floor of the duty-free area

- Next to the Central Pharmacy on the 3rd floor of the Concourse Building

Passenger Terminal 2

Operation hours: 07:00 ~ 21:00

Contact: 032-743-0647

Location: Near Gates 250 and 253 on the 3rd floor of the duty-free area

글 내비게이션

'해외여행' 카테고리의 다른 글

| Korea tour tips for beginner:How to gather Korea tour information, if you are a new to South Korea (0) | 2024.04.06 |

|---|---|

| 티웨이, 키르키스스탄 첫 취항, 키르키스스탄 여행 정보 (마나스 국제공항, 비슈켁, 이쉭쿨 호수) (0) | 2024.03.31 |

| 송도, 공항 리무진 버스 6777번 운행 개시(7월 14일부터) (0) | 2023.07.10 |

| 인천공항 출국 절차, 자동화 현황, 안면인식 스마트패스 도입(7월 말) (0) | 2023.07.10 |

| 인천공항 T1, T2, 일반/면세 구역 약국 정보(위치, 전화번호 등) (0) | 2023.06.25 |

댓글